are combined federal campaign donations tax deductible

The tax rate for amounts over 750 is 33. Each of the types of deductions has subcategories such as charitable contributions student loan interest.

Donations to qualifying charity organizations are deductible on your tax return and may reduce your taxable income and overall tax bill as long as you follow IRS guidelines.

. If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax. The federal contribution limits that apply to contributions made to a federal candidates campaign for the US. There are five types of deductions for individuals work-related itemized education.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. The following information will help you determine. You cannot deduct contributions made to a political.

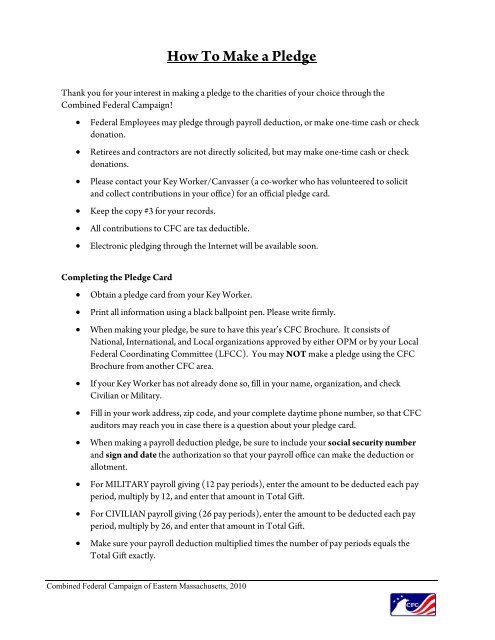

Thank you for contributing through the Combined Federal Campaign CFC. If you can claim how much you. Spreading your gift over the year makes it automatic easier at tax time and it really adds up for your favorite causes.

Federal law does not allow for. While tax deductible CFC deductions are not pre-tax. Donors who are eligible to itemize charitable.

Give through Payroll Deduction. That includes donations to. Plus for tax year 2021 individuals taking the standard deduction can again deduct up to 300 in charitable cash donations and joint filers may deduct up to 600 in cash.

Welcome to the Combined Federal Campaign. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities. If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax.

Your tax deductible donations support thousands of worthy causes. Federal law does not allow for. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax.

Give to Multiple Charities. The CFC is comprised of 30. Federal political contributions are donations that were made to a registered federal political party or a candidate.

If you have donated to an NFP you may be able to claim a tax deduction. Overseen by the Office of Personnel Management OPM the Combined Federal Campaign is the official workplace giving. While tax deductible CFC deductions are not pre-tax.

And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction. A tax deduction allows a person to reduce their income as a result of certain expenses. AFSPs Combined Federal Campaign CFC.

Are Federal Campaign Contributions Tax Deductible. Developing senior leaders in the US. Anonymous political donations could soon be tax deductible.

United Help Ukraine Unitedhelpua Twitter

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Are Political Contributions Tax Deductible Tax Breaks Explained

2022 Combined Federal Campaign Fundraiser Underway Show Some Love Be The Face Of Change National Association Of American Veterans

How To Make A Pledge Combined Federal Campaign Of Eastern

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Home Combined Federal Campaign

2022 Combined Federal Campaign Fundraiser Underway Show Some Love Be The Face Of Change National Association Of American Veterans

11 Tips For Making Your Charitable Donation Count On Your Taxes

Sfa S Mission Statement Funding Sarcoma Cancer Research

Are Political Contributions Tax Deductible Personal Capital

Combined Federal Campaign Cfc Four Reasons It Can Work For You Military Family

What Is The Combined Federal Campaign Article The United States Army

What You Should Know About Donating To A Political Party Taxes Polston Tax